Insurance facebook ads

The insurance industry has a highly competitive nature. So, effective lead generation requires for the growth and success of the business. Fortunately, Facebook Ads offer a cost–effective solution to attain a wider audience and effect quality leads. Whether new to Facebook advertising or looking to enhance your current drives, these tips can help you maximize your lead generation opportunity and upgrade your business level.

Tips for How to Generate Insurance Leads on Facebook

#1 Find Your Crowd

Identify and target the right audience to attain optimal results when advertising ads on Facebook ads for insurance leads. Understanding the specific type of insurance ads and the target market is crucial in choosing the appropriate audience.

One potential target audience for insurance ads is adults aged 25–54 who own a home or a car. This group may be interested in purchasing home insurance or auto insurance policies. Business owners or entrepreneurs are another target audience. They may require commercial insurance policies to safeguard their enterprises.

Parents with young children could be an ideal target audience for life insurance. It provides financial protection for their families. Travel enthusiasts are another potential audience for travel insurance policies to protect them from unexpected events. Lastly, seniors aged 65+ could be the best target audience for Medicare supplemental or other health insurance policies.

Research of more accurate target audiences resulting in more insurance leads.

#2 Stand Out Visually

In a crowded newsfeed, it is critical to use visually stimulating insurance ads to be distinct from the mass. It demands carefully chosen high–quality images and videos to convey the message and connect with the target audience. Bold colours and creative design elements can boost Facebook ads to stand out. However, ensure consistency with brand image. Using branding elements supports building brand recognition and increases trust among potential customers. Engage insurance ads by giving more attention to the target audience’s preference.

#3 Simplify And Solve

Craft the ad copy concisely and clearly. Use easy–to–understand language and avoid confusing technical terminology or complex terms. The message should be simple and to the point.

Use customer feedback, surveys, and other data to create the most effective ad copy that speaks directly to the target audience’s requirements and pain points. Also, it addresses their problems, offers a solution and highlights the benefits.

However, tracking the insights and measurements is necessary to develop the ads.

#4 Powerful words power the work

An impactful call to action (CTA) is vital for insurance agents looking to maximize the effectiveness of Facebook ads. CTA should be precise and motivate the target audience to take action. Consider using action–oriented verbs such as “get a quote,” “sign up,” or “learn more” to uplift users to engage with the ad.

Additionally, urgent phrasing such as “limited time offer” or “act now” can create a sense of urgency and prompt users to take action fast. To further expand the effectiveness of CTA, offer a unique value proposition or incentive. A more effective CTA has the ability to raise the lead immediately.

#5 Reveal the truth to intensify the growth

Trust is a significant factor for humans to concrete any relationship. In Facebook insurance ads, social proof is doing the work of building trust and demonstrating credibility. Therefore, if the insurance ads are complex to understand, the social proof triggers the mind to view the complex ad again. Customer testimonials, case studies, and reviews can be convincing social proof. It exhibits the value of the insurance product or service and displays the overcome of other customers in similar situations. Adding real names and photographs in the proof is strengthening lead generation. The proof must connect to the audience. True statistical values and comparisons have the capability to bring trust.

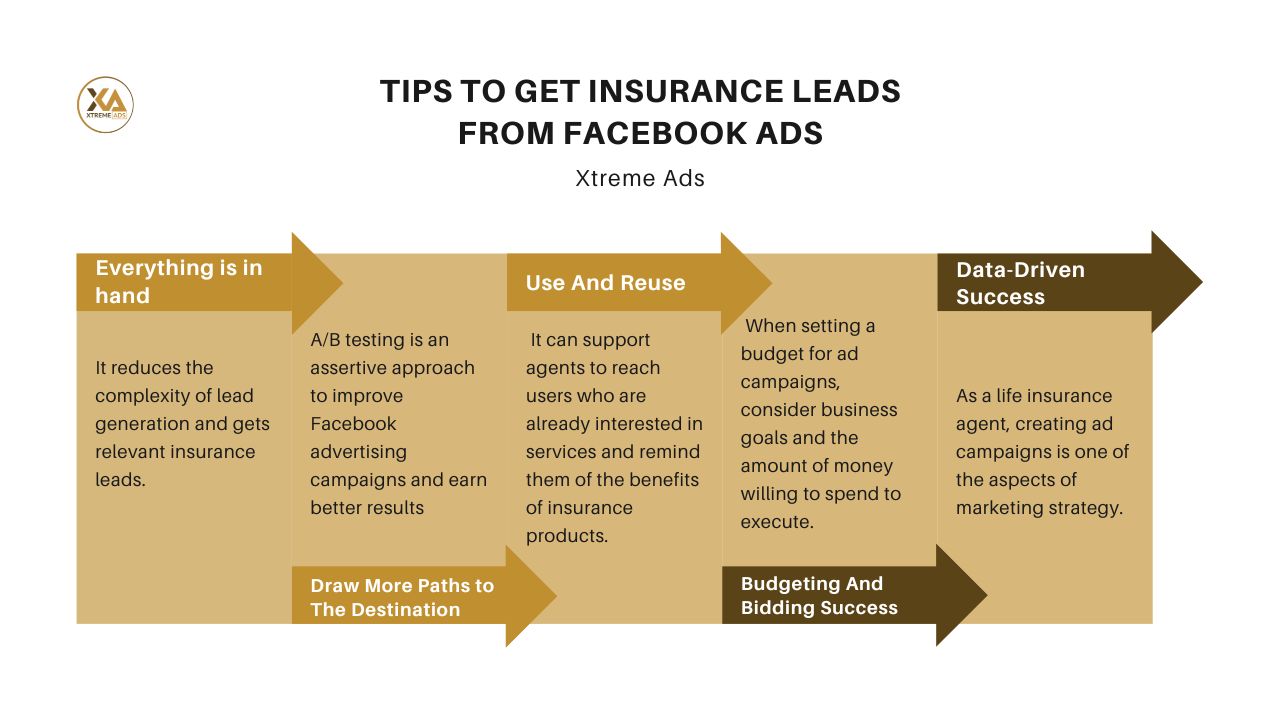

#6 Everything is in hand

Over half of Facebook users are operating the platform through smartphones. So mobile viewing optimization is necessary. If not, you will miss out on a significant portion of the target audience. Create ads mobile friendly. Avoid using text–filled images that may be complicated to read on smaller mobile screens. Also, the landing page must be designed for mobile as well. It reduces the complexity of lead generation and gets relevant insurance leads.

#7 Draw More Paths to The Destination

A/B testing is an assertive approach to improve Facebook advertising campaigns and earn better results. Creating two versions of the ad with variations in images, headlines, or calls to action identifies which version echoes louder with the target audience quickly. Survey ad performance and compile valuable insights with Facebook’s Ad Manager to drive optimization efforts.

#8 Use And Reuse

Facebook ads provide data on the users’ demography, interest, and behaviour for various targeting techniques. Demographic targeting targets users based on characteristics of age, gender, income, and location to reach users curious about insurance services. Interest targeting focuses on users’ interests, hobbies, and activities to reach users who require specific insurance products. Based on user online behaviour, easily target users actively looking for insurance products.

In addition to targeting techniques, insurance agents can also use retargeting to increase the possibility of insurane leads conversion. Retargeting exhibits ads to users who have previously engaged with the Facebook page or visited the website. It can support agents to reach users who are already interested in services and remind them of the benefits of insurance products.

#9 Budgeting And Bidding Success

Establishing a budget for ad campaigns prevents advertising costs within an assigned limit. It is compulsory to allocate resources effectively and efficiently to gain the best results for the business. Bidding strategies are helping to optimize ad performance and reduce costs. Automatic bidding is one of the strategies that involves setting a target cost per action (CPA) and allowing the ad platform’s algorithm to adjust bids in real time to acquire the expected result. It will be valuable to agents looking to maximize ad performance while minimizing costs. When setting a budget for ad campaigns, consider business goals and the amount of money willing to spend to execute.

#10 Data–Driven Success

As a life insurance agent, creating ad campaigns is one of the aspects of marketing strategy. However, launching an insurance ad and hoping for the best is not enough. Ensure ad campaigns are effective by tracking and analysing metrics. Monitoring impressions show the number of times the ad is displayed to users and give an idea of the reach. The number of times users click on the ad explores how many people are interested in the ad and are taking action to learn more about the product or service. To know the ad’s effectiveness, track conversions that show the number of users who take a desired action.

👉 Facebook Ads Pricing & Cost in India

Analysing cost per lead ensures getting the best possible return on investment for the ad campaigns. The article highlights tips and strategies for agents to generate more insurance leads through Facebook Ads, including understanding their target audience, setting up effective ad campaigns, targeting and re–targeting strategies, and monitoring key metrics. By implementing these strategies, insurance agents can unlock the potential of Facebook Ads for lead generation and achieve their business goals.

How can I generate insurance leads using Facebook Ads?

Utilize Facebook’s targeting tools to reach potential clients based on demographics, interests, and behaviors. Craft compelling ad creatives and use lead forms to capture information directly within Facebook.

What are the best Facebook Ad formats for insurance lead generation?

Lead Ads with instant forms are effective for quick conversions. Carousel and video ads can showcase multiple insurance products or explain complex offerings in an engaging manner.

How do I target the right audience for my insurance Facebook Ads?

Define your ideal customer profile and use Facebook’s detailed targeting options, including location, age, interests, and life events. Implement lookalike audiences to reach users similar to your existing clients.

What budget should I allocate for Facebook Ads to get insurance leads?

Start with a modest budget to test ad performance. Monitor metrics like cost per lead and adjust your spending based on the results. Some agents find success with budgets starting around $2,500 per month.

How can I improve the conversion rate of my insurance Facebook Ads?

Ensure your ads have clear calls-to-action, use high-quality visuals, and provide value propositions that resonate with your target audience. A/B testing different ad elements can also help optimize performance.

What common mistakes should I avoid in Facebook Ads for insurance?

Avoid overly broad targeting, neglecting to test different ad creatives, and not following up promptly with leads. Also, ensure compliance with Facebook’s advertising policies to prevent ad disapprovals.